Key Takeaways

- Amazon Web Services (AWS) has made its European Sovereign Cloud generally available, with the first region located in Brandenburg, Germany.

- The new cloud is physically and logically separate from existing AWS Regions and is operated exclusively by EU‑resident staff.

- Pricing of AWS ESC is similar to “normal” AWS regions. Some say there is a 15% markup but my quick research did not show that.

- Although operated by EU-resident staff, the AWS ESC company is a 100% subsidiary of Amazon.com Inc.

- AWS ESC does not offer protection against the US CLOUD Act and it does not help to reduce the strategic dependency of Europe in the digital space.

Introduction

AWS announced that its European Sovereign Cloud (ESC) is now generally available to all customers, in an attempt to provide a cloud environment that meets the strictest European data‑sovereignty and regulatory requirements. The first AWS Region of the ESC is situated in the German state of Brandenburg and is designed to operate independently from the rest of AWS’s global infrastructure. Backed by a €7.8 billion investment, the ESC aims to give public‑sector organisations and heavily regulated industries an air-gapped instance of AWS, operated by an “air-gapped” German subsidiary of Amazon.

How sovereign is it?

The ESC is a physically and logically separate instance of AWS, not connected to other AWS Regions. This means in particular that the AWS ESC has it’s own IAM and metadata, separate from global AWS. All components—including compute, storage, networking and identity services—are located entirely within the EU. Furthermore, Amazon points out that this instance is operated by EU‑resident personnel under European corporate entities. Key features include:

- Data residency: Customer data and metadata (IAM, billing, tags, configurations) remain within the EU unless customers explicitly move them elsewhere.

- Technical isolation: The AWS Nitro System provides hardware‑based isolation, ensuring that even AWS staff cannot access workloads without customer authorization.

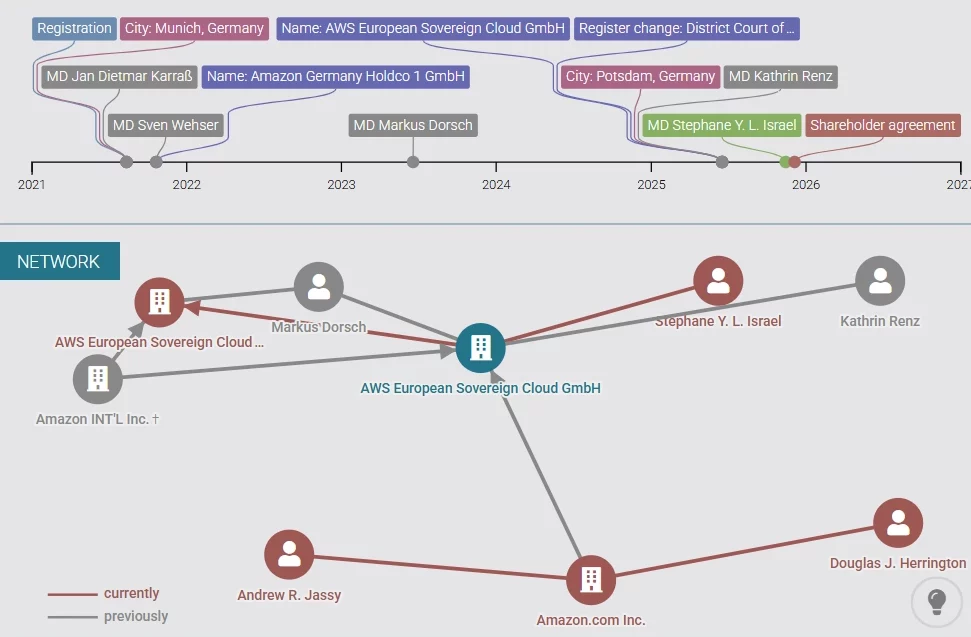

- Governance independence: A dedicated German legal entity, an advisory board composed solely of EU citizens, and a management team led by Stéphane Israël and Stefan Hoechbauer provide operational autonomy. This means the “Kill Switch” is with the German legal entity. Considering worst-case scenarios, AWS ESC would not be killed but starved (no more updates and support from the mother).

- Compliance framework: The ESC‑Sovereign Reference Framework (ESC‑SRF) outlines controls across governance, operational control, data residency and technical isolation, with independent third‑party audits planned for 2026.

Looking up the legal entity AWS European Sovereign Cloud GmbH, we can see that it is a 100% subsidiary of Amazon.com, Inc. (check the Northdata entry on the AWS ESC GmbH). Although organizationally separate, AWS ESC is subject to the US CLOUD Act.

Systematic Sovereignty Assessment

Let’s use the European Commission’s Cloud Sovereignty Framework to assess the Amazon European Sovereign Cloud. The framework defines 8 sovereignty objectives SOV-1 to SOV-8.

SOV-1 Strategic Sovereignty

| Core Intent | Decisive authority within the EU, financing from the EU, EU job creation, consistency with digital, green, and industrial initiatives of the EU |

| Rationale | Financing comes from US, decisive authority is in US and profits go to US. However, AWS is investing in the EU and creating jobs |

| Score (1-4) | 2 |

SOV-2 Legal & Jurisdictional Sovereignty

| Core Intent | Minimizing exposure to non-EU laws and ensuring services are exclusively subject to EU legal frameworks. |

| Rationale | AWS ESC is run by a German legal entity with EU‑based personnel. This company is a 100% subsidiary of Amazon, Inc. and subject to the US CLOUD Act |

| Score (1-4) | 1 |

SOV-3 Data & AI Sovereignty

| Core Intent | Ensuring customer control over cryptographic access to data and strict confinement of storage/processing to EU jurisdictions (including metadata, backups, logs). |

| Rationale | Clients can bring their own keys, storage and processing is confined to ESC through physical separation. AI models are not trained in EU. |

| Score (1-4) | 3 |

SOV-4 Operational Sovereignty

| Core Intent | Assuring that operational support, Security Operations Centers (SOCs), and incident response are delivered from within the EU by EU residents and subject to EU law. |

| Rationale | AWS ESC is operated by EU personnel and it can be assumed that they have all the knowledge and documentation to do so. Vendor lock-in is high |

| Score (1-4) | 3 |

SOV-5 Supply Chain Sovereignty

| Core Intent | Ensuring control and resilience over the entire cloud service supply chain, reducing dependencies on non-EU entities. |

| Rationale | The AWS ESC is fully dependent on the mother AWS |

| Score (1-4) | 1 |

SOV-6 Technology Sovereignty

| Core Intent | Promoting openness, interoperability, non-proprietary APIs, and rights to audit/modify software (e.g., open licenses) to prevent vendor lock-in. |

| Rationale | Ability to integrate is high, some components are based on open source and AWS shares some insights into the design. However, it is proprietary software |

| Score (1-4) | 2 |

SOV-7 Security & Compliance Sovereignty

| Core Intent | Integrating with EU’s legal and operational security fabric (e.g., GDPR, NIS2, DORA) and demonstrating robust security posture |

| Rationale | ESC directly addresses SOV-7 with verifiable controls and EU specific attestations |

| Score (1-4) | 4 |

SOV-8 Environmental Sustainability

| Core Intent | Adhering to energy-efficient infrastructure and circular economy principles, aligning with the EU Green Deal. |

| Rationale | No difference to global AWS |

| Score (1-4) | 3 |

According to my scoring, AWS ESC gets high score on security and compliance, operational sovereignty and relatively high points for environmental sustainability. Key criteria, such as strategic and legal sovereignty are low.

Service Portfolio and Pricing

At launch, the ESC offers a portfolio of roundabout 90 AWS services, spanning AI/ML (Amazon SageMaker, Amazon Bedrock), compute (Amazon EC2, AWS Lambda), containers (EKS, ECS), databases (Amazon Aurora, DynamoDB, RDS), storage (S3, EBS) and security (AWS KMS, Private CA) among others. The pure breadth of service portfolio is not substantially different from what for instance Scaleway is offering. But of course, it is the AWS software stack, so integration and “depth” of service are very high.

Pricing

To get a feeling for the pricing, the table below lists some typical services in AWS ESC, in AWS eu-central-1 (Frankfurt), OVH, and in STACKIT.

| Service | S3 | EC2 / Instance | PostgreSQL |

| Specifications | Standard, 1TB / month | 4 CPU, 16 GB RAM | 4 CPU, 32 GB RAM |

| € 24,67 | € 110,60 (t4g.xlarge) | € 905,32 (db.r6g.xlarge) | |

| € 25,09 | € 112,13 (t4g.xlarge) | € 917,17 (db.r6g.xlarge) | |

| € 8,44 | € 60,71 (b3-16) | € 901,71 (Enterprise DB1-15) | |

| € 26,62 | € 147,54 (g1a.4d) | € 947,65 (Medium) | |

| € 14,60 | € 107.31 (POP2-4C-16G) |

In the sample of S3, compute instance, and PostgreSQL, the ESC was slightly cheaper than AWS eu-central-1 (Frankfurt) in all three categories (I have yet to understand the deviation to this blog post, which researched a 15% premium for ESC). I have added some European providers for reference – but treat the comparison with care. Sometimes it is hard to do a 1 to 1 comparison, because pricing works so differently between providers. This is why I left Scaleway PostgreSQL pricing out. It cannot be directly compared.

The Future of AWS ESC

After establishing the Brandenburg region, AWS plans to roll out Local Zones in Belgium, the Netherlands and Portugal, extending the ESC’s isolation and low‑latency capabilities across the continent. Until this is the case, the AWS ESC does not fulfil the BSI geo-redundancy requirement of 200 km minimum distance between data centres, limiting usefulness in a key target market of ESC: regulated industries, like Financial Services.

It remains to be seen how the market in Europe responds to AWS ESC. Microsoft discontinued a similar attempt with the Microsoft Cloud Deutschland in 2021 after low interest and operational difficulties and overhead with maintaining the air-gapped instance. It is not unlikely that AWS faces similar challenges.

Closing Comments

The launch of the AWS European Sovereign Cloud is a testament to AWS taking concerns in Europe seriously.

It remains to be seen if there is actual interest in a product that so far only exists in one single region, that is behind in service portfolio compared to normal AWS, that may have high operational complexity on AWS side due to the air gap, but that does not solve the issue.

Fact is: European sovereignty is not possible with US Big Tech. Regardless of how they label their products.

References

- seb (2026‑01‑14). “Opening the AWS European Sovereign Cloud“. Amazon Web Services. Retrieved 2026‑01‑16.

- Arjun Kharpal (2026‑01‑15). “Amazon launches its ‘sovereign’ cloud in Europe and plots expansion“. CNBC. Retrieved 2026‑01‑16

- Jürgen Beckers (2026-01-18). “AWS European Sovereign Cloud: Schafft sie Digitale Souveränität – oder nur deren Anschein?“. LinkedIn. Retrieved 2026-01-24