Foreword

A structural problem with the European cloud market is that it is too fragmented. Too many small regional companies are competing against each other and the big ones. The cloud game is an economies of scale game, after all. Some voices are drawing the parallel to Airbus as an example how European firms had joined forces to compete with Boeing.

One of the European cloud companies with the potential to play a pivotal role is Schwarz Digits with their hyperscaler STACKIT. Several circumstances and ingredients are coming together for them, giving me hope and raising my expectations. Let’s go through them one by one.

Family/foundation owned

Enabling unified decision making with long term strategy and vision

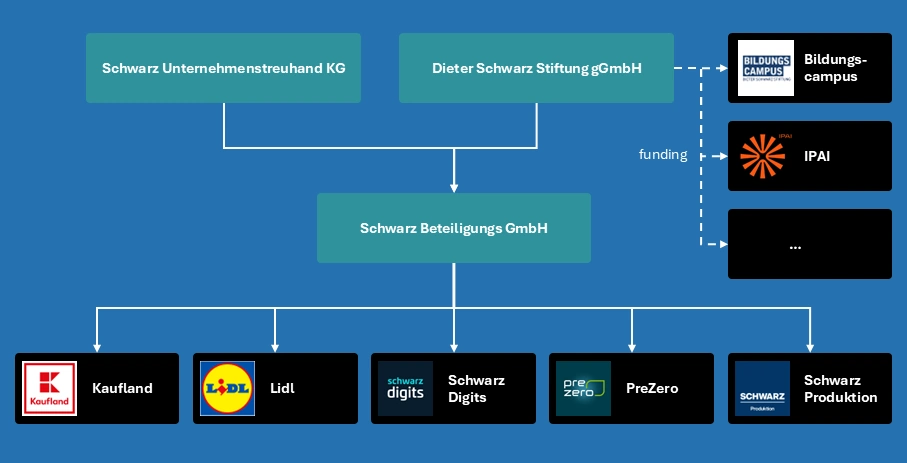

Schwarz Digits with it’s hyperscaler brand STACKIT is the digital branch of the Schwarz Gruppe, which is owned by the Dieter Schwarz Foundation. The foundation functions as the pivotal controlling entity for the entire Schwarz Gruppe, using some of the generated dividends for charitable activities, especially for education (see below). This foundation holds 99.9% ownership of Schwarz Beteiligungs GmbH, the ultimate holding company for the group’s operations. This ownership consolidation is a deliberate mechanism to prevent the fragmentation of control that often plagues family businesses across generations, ensuring a unified decision-making process and a consistent long-term strategic direction.

The following simplified diagram of the Schwarz Gruppe shows how the Dieter Schwarz Foundation and the operative units relate to each other. This is not a legal ownership chart, but a schematic diagram of the relationships. More details about ownership and voting rights can be found in the German Wikipedia article on the Schwarz Gruppe.

The ownership structure means that

- The Schwarz Gruppe (and its parts) cannot be bought

- unified decision making means they have the power to push through ambitious, long-term endeavours

- longer-term strategic vision is easier to follow through when they do not have to optimize for short-term shareholder value

Giant retailer in the back

Enabling access to capital and to large markets

The Schwarz Group is one of the very large European retail conglomerates, with the household brands Lidl and Kaufland.

Together, the companies under the Schwarz Group umbrella have almost 600k employees and a yearly revenue of 1,5bn €. Being part of this group has several advantages for the cloud provider STACKIT:

- Access to capital – The group can provide substantial capital to the cloud provider. The 11bn € data centre in Lübbenau is a testament of the financial power behind STACKIT. It also means independence from short-term capital market interests.

- Bootstrapping – A key difficulty for any hyperscaler challenger is a chicken-egg-problem: they need a good product to generate revenue. But to build a good product, they need revenue. The Schwarz Group has the means to solve this problem. Besides access to capital, they are a significant user of the cloud platform themselves. They can pull themselves up until the machine runs on its own.

- Market leverage – through its retail operations, the Schwarz Group has enormous market power and leverage to create momentum around its hyperscaler and to convince partners and clients.

- A safe bet – “people will always eat”. The Schwarz Group will be around and relevant for the foreseeable future. Furthermore, the group is a business partner as reliable and trustworthy as the Big Tech companies, if not more. Schwarz Digits and STACKIT have all the ingredients to counter the “nobody gets fired for buying

IBMAWS” phenomenon and actually be the safer and more trustworthy bet for Europeans.

Partnerships where it makes sense

Schwarz Digits are partnering with many companies to compile a platform that is relevant and attractive for German/European enterprise. To name a few:

- Rise with SAP on STACKIT – RISE with SAP, SAP’s ambitious play to shepherd its vast legion of on-premise ERP users into the cloud era, is going to be available with STACKIT as a cloud target. This collaboration is a catalyst for the maturity of the STACKIT cloud platform and a great option for SAP clients to rely on an European partner for infrastructure.

- Tableau on STACKIT – STACKIT is partnering with Salesforce to bring Tableau and MuleSoft as managed services to the STACKIT platform. Says Bernie Wagner, CEO of STACKIT: “We need innovative technologies without losing control over our data. Together with Salesforce, that’s exactly what we offer: We combine leading analytics and integration technologies with consistent data sovereignty.”

- ServiceNow on STACKIT – like with SAP, the ServiceNow partnership helps to increase attractiveness of the STACKIT cloud platform for enterprise clients. In the IT Service Management (ITSM) market, ServiceNow holds a market share around 40-50%. Gartner’s 2023 data further solidifies this dominance, ranking ServiceNow No. 1 in ITSM Platforms. These high-relevance, high-profile partnerships can be a key differentiator for Schwarz Digits.

- Workspace by STACKIT – the most controversial partnership. Under the brand Workspace by STACKIT, Schwarz Digits are offering their own version of Google Workspace. This is the version of Google Workspace that the Schwarz Group themselves migrated to, after “values were no longer aligned” between Microsoft and the Schwarz Group. While the Workspace software itself is operated and maintained by Google in Google data centers, the data lives in STACKIT data centers. As it is encrypted on the client with keys of Schwarz Digits, they claim that there is no way Google can access client data.

- Wire on STACKIT – In April 2024, the secure communication tool Wire and the Schwarz Group announced a strategic partnership to provide a secure, European alternative to messaging tools where security and confidentiality are always being questioned. Wire on STACKIT fully runs on STACKIT infrastructure in central Europe. Furthermore, Wire and the Schwarz Group are planning to invest in joint product development. There are two flavors of Wire: the public one, where you can download an app in a mobile app store and a private instance, for extra security and protection. A testament of the security of Wire is the fact that “Wire has a clearance recommendation for the communication of ‘classified information – for official use only’ by the Federal Office for Information Security (BSI),” according to Rolf Schumann, Co-CEO at Schwarz Digits.

- IPAI and Aleph Alpha – see below.

- Partner Ecosystem – Schwarz Digits has built a large partner ecosystem. On the one hand, there are ISV partners that are hosting their software on the STACKIT platform. On the other hand, there is an ecosystem of professional services partners, including the brilliant minds of Netlight Consulting. These partners are designing and implementing solutions on the STACKIT platform, and who can give professional advice on STACKIT.

Part of a larger plan

One factor that makes me confident and optimistic about the STACKIT cloud platform is that the Schwarz Group and the Dieter Schwarz Foundation have a demonstrated larger strategy, in which the cloud platform is a key element.

Investment in Education, Research and Innovation

A larger strategy becomes visible with the investments in education and into future bright minds with the Bildungscampus Heilbronn. The Bildungscampus is housing a branch of Technische Universität München, of ETH Zürich, a Fraunhofer research and innovation center, a Max Planck institute, the Heilbronn University of Applied Sciences and many more. It is rapidly growing with 8.000 students at present and potentially reaching 20.000 students in the years ahead.

Investment in AI Development

Aleph Alpha

Alongside the investments into the hyperscaler, the Schwarz Foundation is heavily investing into European AI research and development. The investments into Aleph Alpha, and the integration of Aleph Alpha into the overall plan are signs of the AI ambition.

Innovation Park AI (IPAI)

The even larger investment into AI is the IPAI Innovation Park AI, which shall accommodate 5.000 AI researchers and developers and is going to become one of the largest AI research and development centres in Europe. Although still under construction, already 80 companies and institutions are involved. With the talent-producing Bildungscampus Heilbronn in the back, the IPAI is well-positioned to become a global centre for responsible AI development, or, as they say themselves: The Global Home of Human AI.

Conclusion

The European cloud market faces significant fragmentation, but Schwarz Digits—backed by the Schwarz Gruppe and its unique foundation-owned structure—has the potential to make a decisive difference through unified vision, deep capital reserves, and a far-reaching strategic roadmap.

With STACKIT, Schwarz Digits is not only leveraging its retail giant for scale and market access but also forging strong partnerships to deliver trusted, sovereign cloud solutions tailored to European needs.

Their investments in education, research, and AI signal a forward-thinking commitment that extends far beyond technology infrastructure; it is about creating an enduring ecosystem for innovation and talent and European relevance in the digital space.

If Europe is to forge an “Airbus for the digital age,” Schwarz Digits and STACKIT clearly have the ingredients, momentum, and long-term ambition to be pivotal players—leading by example towards greater resilience, sovereignty, and competitiveness in the global cloud and AI landscape.